Broadcom made a $130 billion bid to acquire rival chip maker Qualcomm, a deal which would be the biggest ever struck for a technology company and one of the largest of all time.

The transaction is worth $70 per share in cash and stock and includes proposals to clear Qualcomm’s $25 billion of net debt. Broadcom said it will honour a deal regardless of whether Qualcomm’s pending acquisition of NXP Semiconductors is approved.

In a statement, Broadcom said its advisors were confident the nature of the deal would mean it was cleared by regulators in a “timely manner” and expected it to be completed within a year of being accepted.

The bid comes days after intense speculation Broadcom was set to make a $100 billion offer – a sum Bloomberg reported would be rejected by Qualcomm as it “undervalued” the company.

In a letter to Qualcomm shareholders, Broadcom CEO Hock Tan said: “A combination of Qualcomm and Broadcom will create a strong, global company with an impressive portfolio of industry-leading technologies and products.

“Given the highly complementary nature of our businesses, we are confident that our global customers will embrace the proposed combination as we work strategically with them to deliver more advanced value-added semiconductor solutions.”

Review

Qualcomm confirmed it received the unsolicited offer.

In a statement, it added: “The Qualcomm board of directors, in consultation with its financial and legal advisors, will assess the proposal in order to pursue the course of action that is in the best interests of Qualcomm shareholders. Qualcomm will have no further comment until its board of directors has completed its review.”

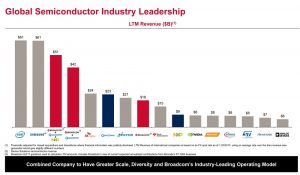

(see chart from Broadcom, left – click to expand).

A deal between Broadcom and Qualcomm would be the largest acquisition of a technology company to date and would create the world’s third-largest chipmaker behind Intel and Samsung

The current highest successful bid for the purchase of a chip company is Qualcomm’s $38 billion deal for NXP Semiconductors, an acquisition still going through a lengthy regulatory approval process.

Broadcom’s shareholder offer is equivalent to Qualcomm’s share price in May 2015, prior to a well-publicised legal spat with Apple,which hit recent earnings and its share price.