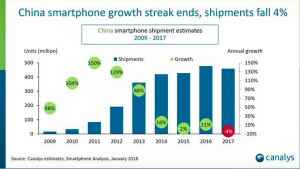

China’s smartphone market, the world’s largest, suffered its first-ever annual decline in 2017, with shipments falling 4 per cent from 2016 to 459 million units (see chart below, click to enlarge).

Canalys said the drop was partly due to China having one of its worst performances in Q4 2017, with shipments dropping 14 per cent year-on-year to just under 113 million units.

Huawei increased shipments 9 per cent year-on-year to more than 24 million units, one of its best ever in its home market, to remain the top vendor on the mainland. Shipments by second and third-placed vendors Oppo and Vivo fell 16 per cent and 7 per cent respectively: Oppo shipped 19 million smartphones, Vivo 17 million. Apple took fourth place from Xiaomi, which shipped 13 million units in Q4 and dropped to fifth. (Canalys didn’t provide a figure for Apple shipments.)

For the full year, Huawei’s shipments reached 90 million units.

Gaining share

“Huawei’s push into tier-three and tier-four cities has yielded positive results,” said Canalys research analyst Mo Jia: “Nova and Honor have successfully gained share from smaller vendors, such as Gionee and Meizu. Honor’s performance has complemented Huawei’s success, by contributing more than half of Huawei’s total shipments. But competition between Huawei and Honor is getting fierce, and Huawei must deal with possible internal cannibalisation.”

Despite the dip in Q4, Oppo and Vivo both registered double-digit growth in 2017.

“The market has slowed faster than expected. Being aware of inventory issues, both vendors have set up flagship stores in tier-one cities to boost their branding and drive value growth,” said Jia: “Failure to drive footfall, however, will threaten Oppo and Vivo’s ongoing channel transformation and render the exercise futile.”

Weakness in China will have a detrimental impact on local vendors which rely heavily on their home market, Canalys research analyst Hattie He said: “It will affect their cashflow and profitability, limiting overseas expansion and bringing into question future survival. The threat to vendors such as Gionee and Meizu is now closer than ever.”

With Lenovo and ZTE refocusing on the Chinese market this year, competition will intensify among vendors outside the top five, He said adding this leaves little room for the smaller vendors: “The leading players will make aggressive plans to maintain or grow their market share. We can expect a major market shake-up in China in 2018.”